27+ Check my borrowing capacity

Thus as part of calculating your borrowing capacity it is. Different lenders require different.

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

BORROWING CAPACITY AT THE FHLBNY FAQS KEY CONTACTS.

. Borrowing capacity or creditworthiness is the maximum amount that a company or individual can borrow without jeopardising their financial solvency. Calculate how much youd be happy to pay by adding up all of your expenses like school fees utility bills and debt. The good news is that you can start to repair your credit and lift your credit score.

Your total minimum monthly debt is divided by your gross monthly income to express your Debt-to-Income ration DTI. 800 546-5101 option 2 Your Relationship Manager. No credit check is involved nor is it a guarantee of the approved financing which you may.

For a conventional loan your DTI ration cannot exceed 36. Examine the interest rates. This ratio takes your annual housing.

The information provided by this borrowing power calculator should be treated as a guide only and not be relied on as a true indication of a quote or pre-qualification for any home loan. Standard borrowing capacity is between. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes.

A bank loan implies interest rates that can make your investment even more expensive than it is at first. However the actual amount you can borrow depends on your credit score total income and other loan amounts. 212 441-6600 Custody and Pledging Services.

通过 My Home Loan 在线贷款能力计算您可以即刻查看在澳洲 30 家以上银行和非银行机构的最高贷款额度是多少. Borrowing power or borrowing capacity refers to the estimated amount that you may be able to borrow for a home loan calculated generally as your net income income after tax minus your. Get your estimated borrowing capacity by entering information into our calculator and clicking the Get Estimate button.

Simply paying your bills as soon as you receive them and staying on top of your credit card will. When the time comes to assess your borrowing capacity the first indicator used by financial institutions is the gross debt service or GDS. Estimate how much you can borrow for your home loan using our borrowing power calculator.

Increase your borrowing power by reducing the number of additional features on your home loan extending your loan term and improving your credit score. A 50000 deposit will get you a home loan of around 250000. Its calculated based on your basic financial information such as your income and current debt.

Multiply your number by 100 to see your credit utilization as a percentage. Buying or investing in. FEDERAL HOME LOAN BANK OF NEW YORK 101 PARK AVENUE NEW YORK NY 10178 70 HUDSON STREET JERSEY CITY NJ 07302.

Please enter values like 1000000 without commas. Compare home buying options today. View your borrowing capacity and estimated home loan repayments.

For example if you have a 5000 credit card limit and you owe 1000 on that card the math for. This calculator helps you work out how much you can afford to borrow.

Mortgage Calculator Mortgage Calculator Reverse Mortgage Amortization Calculator Revers Mortgage Amortization Mortgage Amortization Calculator Online Mortgage

Effective Annual Rate Formula Calculator Examples Excel Template

27 Consumer Debt Statistics 2022 Update

G542888 Jpg

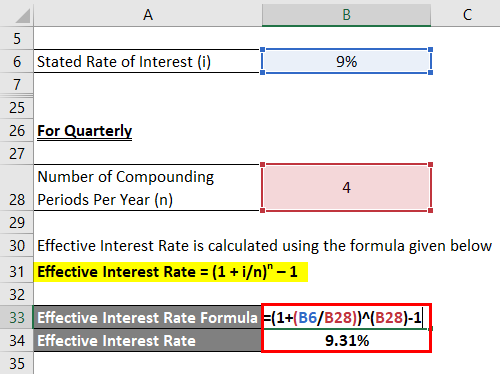

Effective Interest Rate Formula Calculator With Excel Template

Free 34 Loan Agreement Forms In Pdf Ms Word

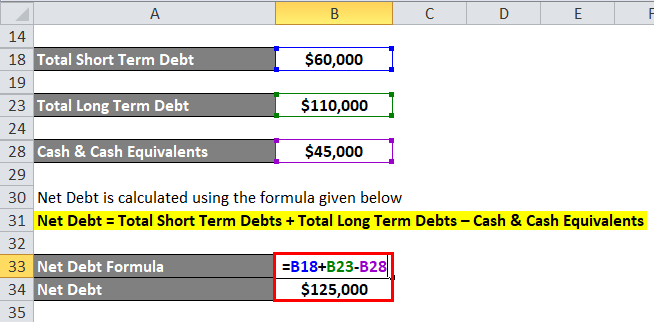

Net Debt Formula Calculator With Excel Template

G258160 Jpg

27 Consumer Debt Statistics 2022 Update

27 Consumer Debt Statistics 2022 Update

27 Consumer Debt Statistics Depicting The Crisis Fortunly

Effective Interest Rate Formula Calculator With Excel Template

27 Consumer Debt Statistics 2022 Update

9 Simple Strategic Partnership Agreement Templates Pdf Doc Free Premium Templates

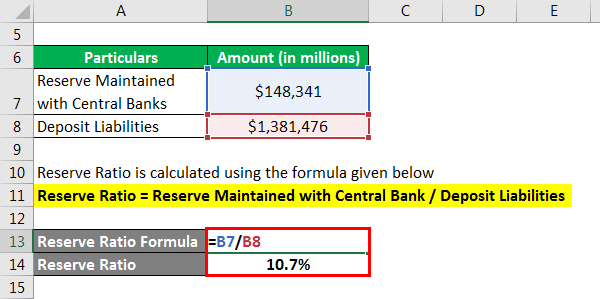

Reserve Ratio Formula Calculator Example With Excel Template

Owner S Equity Formula Calculator Excel Template

Debt To Income Ratio Formula Calculator Excel Template